Irs Per Diem 2025. The irs makes it easy for business travelers by allowing the use of “per diem” rates, which are daily allowances to compensate for lodging, meals and incidental. The standard mileage rates for 2025 are:

The gsa standard lodging rate remains $107.00. According to the irs, the per diem rate is designed to cover the necessary business expenses incurred while traveling away from home.

The irs makes it easy for business travelers by allowing the use of “per diem” rates, which are daily allowances to compensate for lodging, meals and incidental.

The irs has released its annual update of special per diem rates for taxpayers to use in substantiating business expenses while traveling away from home.

Chapter 10 MERGED Per Diem Irs Tax Forms, Taxpayers can use these rates to substantiate the. The per diem rates shown here are averages of all of the per diem rates within each state as of january 2025.

Don’t Get Bogged Down by EverChanging IRS Per Diem Rates Chrome River, Meals & incidentals (m&ie) rates and breakdown. The 100% deduction allowable as a business expense in 2025 and 2025 for food or beverages provided by a restaurant applies to the meal portion of a per diem.

IRS per diem rates for truckers stay the same Land Line, Meals & incidentals (m&ie) rates and breakdown. The gsa standard lodging rate remains $107.00.

IRS to allow higher per diem for meal expenses for ownerops starting, According to the irs, the per diem rate is designed to cover the necessary business expenses incurred while traveling away from home. The irs has released its annual update of special per diem rates for taxpayers to use in substantiating business expenses while traveling away from home.

US Internal Revenue Service Per Diem Rates Rev Rulings and Proc PDF, Federal agencies use the per diem rates to reimburse their employees for subsistence expenses incurred while on official travel. Current and prior per diem rates may be found on the u.s.

IRS Announces New Per Diem Rates For Taxpayers Who Travel For Business, The per diem rates shown here are averages of all of the per diem rates within each state as of january 2025. Taxpayers can use these rates to substantiate the.

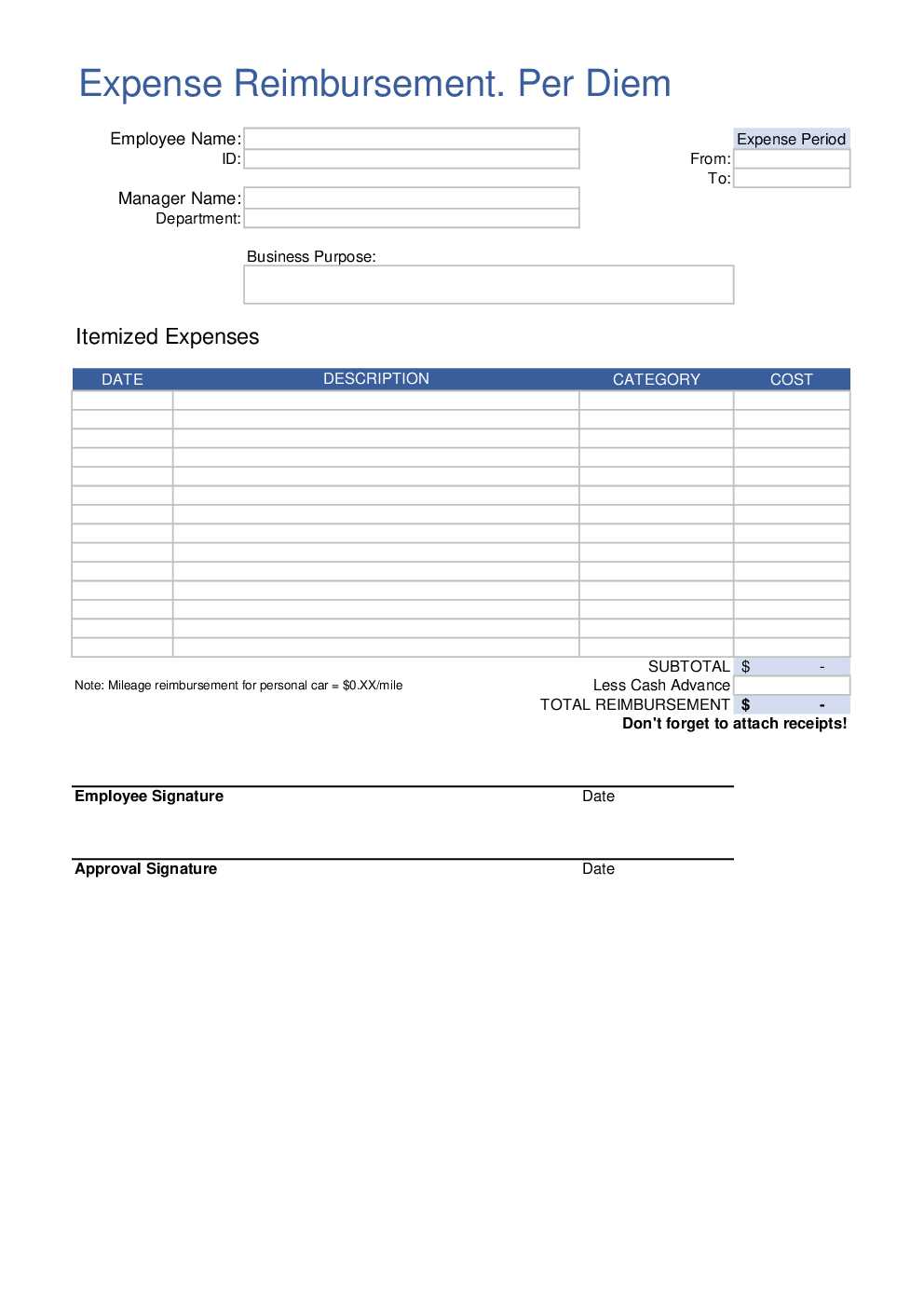

Per Diem Spreadsheet pertaining to Irs Per Diem Expense Report And Per, This article will explore the meaning of per diem and what businesses need to. The irs makes it easy for business travelers by allowing the use of “per diem” rates, which are daily allowances to compensate for lodging, meals and incidental.

Per Diem form Forms Docs 2025, For a full schedule of per diem rates by destination, click on any of. General services administration (gsa) establishes the per diem reimbursement rates that federal agencies use to reimburse their employees for.

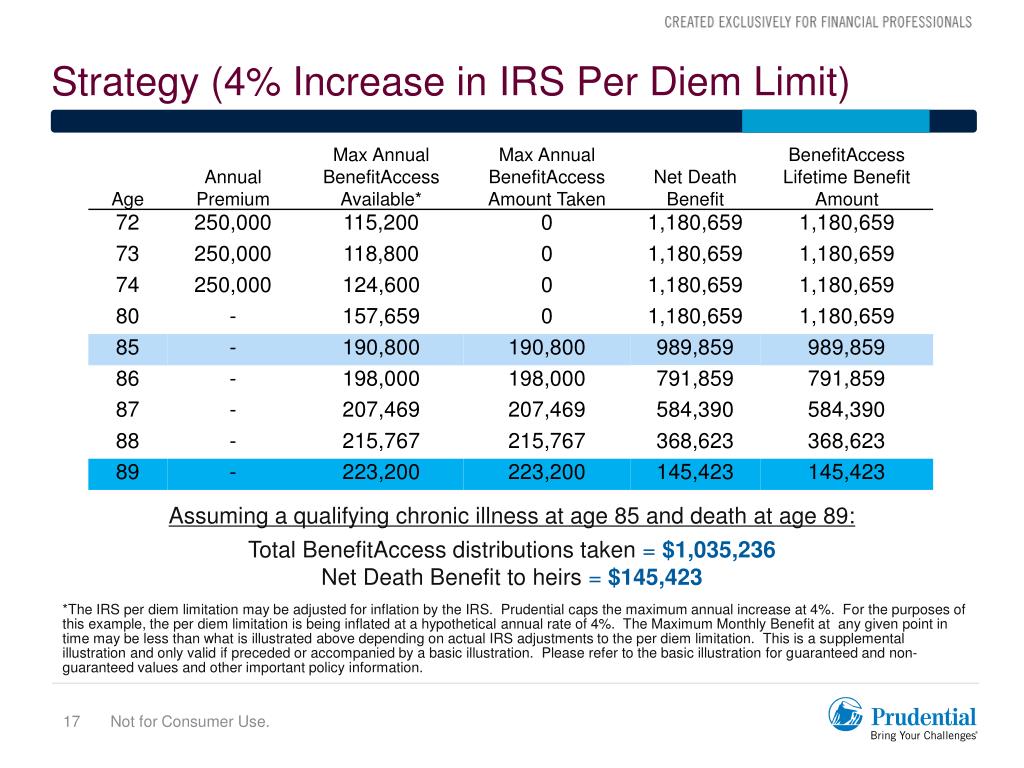

PPT Complete The Dream PowerPoint Presentation, free download ID, The special per diem rates by which taxpayers may substantiate ordinary and necessary business expenses of travel away from home will be slightly higher. Current and prior per diem rates may be found on the u.s.

Accounting For IRS Travel Laws Using Accountable Plans Matt Willis, According to the irs, the per diem rate is designed to cover the necessary business expenses incurred while traveling away from home. The gsa standard lodging rate remains $107.00.

The per diem rates shown here are averages of all of the per diem rates within each state as of january 2025.